The following chart provides summary information about each of our director nominees’ skillsqualifications and experiences. More detailed information is provided in each director nominee’s biography beginning on page 7.8.

Patrick J. Moore | 🌑 | | 🌑 | | 🌑 | | 🌑 | | 🌑 | | | | 🌑 | | 🌑 | 2 | | | | | | | | | Francisco J. Sanchez | | | | ADM Proxy Statement 2017🌑 |

PROXY SUMMARY

VOTING MATTERS AND BOARD RECOMMENDATIONS

| | | | | 🌑 | | | | | | 🌑 | Proposal | | Board Voting

Recommendation | | | | | | | Debra A. Sandler | | | | 🌑 | | | | Page

Reference 🌑 | | | | 🌑 | | | | 🌑 | Proposal No. 1 — Election of Directors

| | FOR | | 6 | | | | | Proposal No. 2 — Ratification of Appointment of Independent Registered Public Accounting FirmLei Z. Schlitz

| | | | 🌑 | | | | 🌑 | | | | | | | | 🌑 | | | FOR | | 57

| | | | | Proposal No. 3 — Advisory Vote on Executive CompensationKelvin R. Westbrook

| | FOR🌑 | | 58

| Proposal No. 4 — Advisory Vote on Frequency of Advisory Vote on Executive Compensation

| | ONE YEAR | | 59🌑 | | 🌑 | | 🌑 | | 🌑 | | 🌑 |

| | | ADM Proxy Statement 20172020 | | 3 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTINGProxy Summary

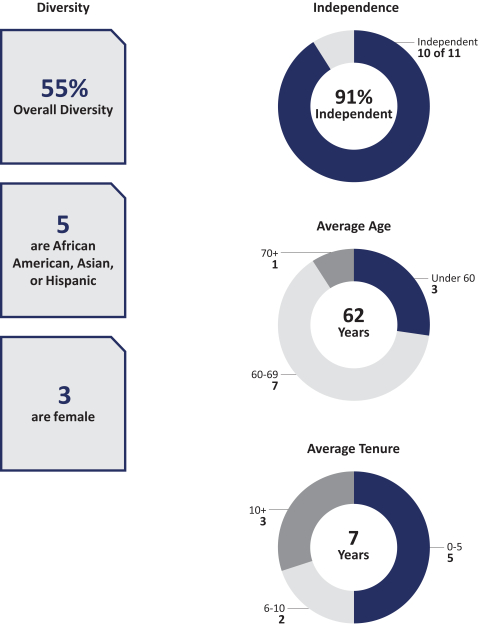

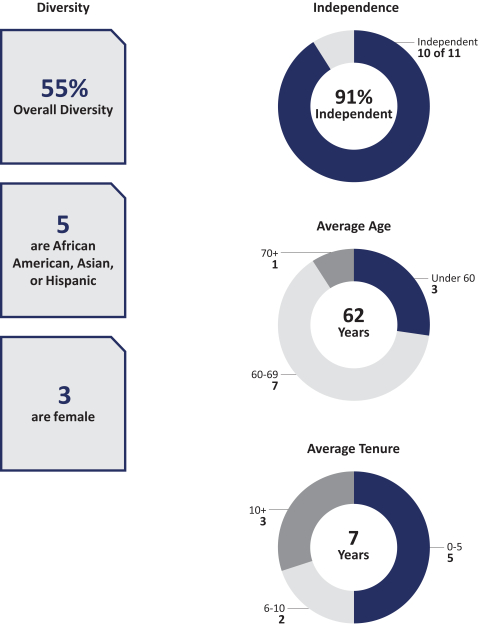

Director Nominee Diversity, Age, Tenure, and Independence PROXY STATEMENTDirector Nominee Diversity, Age, Tenure, and Independence

The following charts provide summary information about our director nominees’ personal characteristics, including race/ethnicity, gender, and age, as well as tenure and independence, to illustrate the diversity of perspectives of our director nominees. More detailed information is provided in each director nominee’s biography beginning on page 8.

Diversity 55% Overall Diversity Independence Independent 10 of 11 91% Independent 5 are African American, Asian, or Hispanic Average Age 1 70+ 7 60-69 3 Under 60 62 Years 3 are female Average Tenure 7 Years 3 10+ 2 6-10 5 0-5. | | | | 4 | | ADM Proxy Statement 2020 |

General MattersInformation About the Annual Meeting and Voting Our board

Proxy Statement GENERAL MATTERS The Board of directorsDirectors asks that you complete the accompanying proxy for the annual stockholders’ meeting. TheDue to concerns about the coronavirus (COVID-19), this year the meeting will be completely virtual and will be held at the time place, and locationweb address mentioned in the Notice of Annual Meeting included in these materials. This year, weWe will be using the “Notice and Access” method of providing proxy materials to stockholders via the internet. We will mail to our stockholders (other than those described below) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and the 20162019 Annual Report onForm 10-K and how to vote electronically via the internet. This notice will also contain instructions on how to request a paper copy of the proxy materials. ThoseStockholders holding shares through the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees (the “401(k) and ESOP”) and those stockholders who previously have previously opted out of participation in notice and access procedures will receive a paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email. We are first providing our stockholders with notice and access to, or first mailing or emailing, this proxy statement and a proxy form around March 24, 2017.25, 2020. We pay the costs of soliciting proxies from our stockholders. We have retained Georgeson LLC to help us solicit proxies. We will pay Georgeson LLC a base shareholder meeting services fee of approximately $24,000 plus reasonable project management fees and expenses for its services. Our employees or employees of Georgeson LLC may also solicit proxies in person or by telephone, mail, or the internet at a cost which we expect will be nominal. We will reimburse brokerage firms and other securities custodians for their reasonable fees and expenses in forwarding proxy materials to their principals. We have a policy of keeping confidential all proxies, ballots, and voting tabulations that identify individual stockholders. Such documents are available for examination only by the inspectors of election, our transfer agent, and certain employees associated with processing proxy cards and tabulating the vote. We will not disclose any stockholder’s vote except in a contested proxy solicitation or as may be necessary to meet legal requirements. Our common stockholders of record at the close of business on March 13, 2017,16, 2020, are the only people entitled to notice of the annual meeting and to vote at the meeting. At the close of business on March 13, 2017,16, 2020, we had 570,666,483557,207,815 outstanding shares of common stock, each share being entitled to one vote on each of the eleven director nominees and on each of the other matters to be voted on at the meeting. Our stockholders and advisors to our company are the only people entitled to attend the annual meeting. We reserve the right to direct stockholder representatives with the proper documentation to an alternative room to observe the meeting. AllThe annual meeting this year will be a completely virtual meeting of stockholders. Hosting a virtual meeting provides expanded access, improved communication, and cost savings for our stockholders will need a form of photo identification to attendand us and enables participation from any location around the world. Stockholders may submit questions during the annual meeting at www.virtualshareholdermeeting.com/ADM2020, and management will respond to questions in the same way as it would if the company held an in-person meeting. If you are a stockholder of record and plan to attend, please detach the admission ticket from the top of your proxy card and bring it with you to the meeting. The number of people we will admit tohave questions during the meeting, will be determined by howyou may type them in the shares are registered, as indicated on the admission ticket. If you are a stockholder whose shares are held by a broker, bank, or other nominee, please request an admission ticket by writing to our officedialog box provided at Archer-Daniels-Midland Company, Investor Relations, 4666 Faries Parkway, Decatur, Illinois 62526-5666. Your letter to our office must include evidence of your stock ownership. You can obtain evidence of ownership from your broker, bank, or nominee. The number of tickets that we send will be determined by the manner in which shares are registered. If your request is received by April 20, 2017, an admission ticket will be mailed to you. Entities such as a corporation or limited liability company that are stockholders may send one representative to the annual meeting, and the representative should have apre-existing relationship with the entity represented. All other admission tickets can be obtained at the registration table located at the James R. Randall Research Center lobby beginning at 7:30 A.M. on the day of the meeting. Stockholders who do notpre-register will be admitted toany point during the meeting only upon verification of stock ownership.

The use of cameras, video or audio recorders or other recording devices inuntil the James R. Randall Research Centerfloor is prohibited. The display of posters, signs, banners or any other type of signage by any stockholder in the James R. Randall Research Center is also prohibited. Firearms are also prohibited in the James R. Randall Research Center.

Any requestclosed to deviate from the admittance guidelines described above must be in writing, addressed to our office at Archer-Daniels-Midland Company, Secretary, 77 West Wacker Drive, Suite 4600, Chicago, Illinois 60601 and received by us by April 20, 2017. We will also have personnel in the lobby of the James R. Randall Research Center beginning at 7:30 A.M. on the day of the meeting to consider special requests.questions.

If you properly execute the enclosed proxy form, your shares will be voted at the meeting. You may revoke your proxy form at any time prior to voting by: (1) delivering written notice of revocation to our Secretary;

(2) delivering to our Secretary a new proxy form bearing a date later than your previous proxy; or

(3) attending the meeting and voting in person (attendance at the meeting will not, by itself, revoke a proxy).

| (1) | delivering written notice of revocation to our Secretary; |

| (2) | | | 4 | | ADM Proxy Statement 2017delivering to our Secretary a new proxy form bearing a date later than your previous proxy; or |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| (3) | attending the annual meeting online and voting again (attendance at the online meeting will not, by itself, revoke a proxy). |

Under our bylaws, stockholders elect our directors by a majority vote in an uncontested election (one in which the number of nominees is the same as the number of directors to be elected) and by a plurality vote in a contested election (one in which the number of nominees exceeds the number of directors to be elected). Because this year’s election is an uncontested election, each director | | | | ADM Proxy Statement 2020 | | 5 |

General Information About the Annual Meeting and Voting Principal Holders of Voting Securities nominee receiving a majority of votes cast will be elected (the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that nominee). Stockholders are asked to provide an advisory vote on whether the advisory vote on the compensation of our named executive officers should be held every one, two or three years. The option among these choices that receives the affirmative vote of the holders of a plurality of the shares present in person or represented by proxy and entitled to vote on the matter will be deemed to have received the advisory approval of stockholders. Approval of each other proposal presented in the proxy statement requires the affirmative vote of the holders of a majority of the outstanding shares of common stock present, in persononline or by proxy at the meeting and entitled to vote on that matter. Shares not present at the meeting and shares voting “abstain” have no effect on the election of directors. For the other proposals to be voted on at the meeting, abstentions are treated as shares present or represented and voting, and therefore have the same effect as negative votes. Brokernon-votes (shares held by brokers who do not have discretionary authority to vote on the matter and have not received voting instructions from their clients) are counted toward a quorum, but are not counted for any purpose in determining whether a matter has been approved. PRINCIPAL HOLDERS OF VOTING SECURITIESPrincipal Holders of Voting Securities

Based upon filings with the Securities and Exchange Commission (“SEC”), we knowbelieve that the following stockholders are beneficial owners of more than 5% of our outstanding common stock shares: | | | | | Name and Address of Beneficial Owner | | Amount | | Percent Of Class | | | | State Farm Mutual Automobile Insurance Company and related entities One State Farm Plaza, Bloomington, IL 61710 | | 51,455,676(1) | | 9.23 | | | 56,575,742(1) | | 9.87 | The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | | 44,946,621(2) | | 8.06 | | | 41,725,222(2) | | 7.25 | BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | | 38,454,597(3) | | 6.90 | | | 39,497,600(3) | | 6.90 | State Street

Corporation One Lincoln Street, Boston, MA 02111 | | 34,270,74737,082,871(4) | | 5.966.66 |

(1) Based on a Schedule 13G filed with the SEC on January 23, 2017,27, 2020, State Farm Mutual Automobile Insurance Company and related entities have sole voting and dispositive power with respect to 56,294,74251,214,613 shares and shared voting and dispositive power with respect to 281,000241,063 shares. (2) Based on a Schedule 13G/A filed with the SEC on February 9, 2017,12, 2020, The Vanguard Group has sole voting power with respect to 905,282821,863 shares, sole dispositive power with respect to 40,714,93643,993,781 shares, shared voting power with respect to 106,153174,423 shares, and shared dispositive power with respect to 1,010,286952,840 shares. (3) Based on a Schedule 13G/A filed with the SEC on January 19, 2017,February 5, 2020, BlackRock, Inc. has sole voting power with respect to 32,231,34232,389,168 shares and sole dispositive power with respect to 39,497,60038,454,597 shares. (4) Based on a Schedule 13G filed with the SEC on February 9, 2017,13, 2020, State Street Corporation has shared voting power with respect to 33,876,563 shares and shared dispositive power with respect to 34,270,74737,048,786 shares. | | | | 6 | | ADM Proxy Statement 20172020 | | 5 |

PROPOSAL NO.Proposal No. 1

PROPOSAL NO.Proposal No. 1 — ELECTION OF DIRECTORS FOR AElection of Directors for aONE-YEAROne-Year TERMTerm

Our boardThe Board of directorsDirectors has fixed the size of the current board at twelve. Ms. Carter and Mr. Maciel, both current members of our board of directors, have determined not to stand forre-election. As of March 13, 2017, Ms. Carter beneficially owned 11,581,132 shares of our common stock, consisting of 2,432,349 shares held in a family foundation or owned by or in trust for members of Ms. Carter’s family, 74,003 shares held in an individual retirement account, 8,918,000 shares held in a limited partnership and 156,780 stock units allocated under our Stock Unit Plan for Nonemployee Directors, which are deemed to be the equivalent of outstanding shares of common stock, and Mr. Maciel beneficially owned 25,382 shares of our common stock, all of which consisted of stock units allocated under our Stock Unit Plan for Nonemployee Directors. Upon the recommendation of the Nominating/Corporate Governance Committee, the board of directors has determined at this time not to fill one of the vacancies that will occur as a result of Ms. Carter’s and Mr. Maciel’s departures and has, accordingly, fixed the number of director nominees at eleven.

Ten of the All eleven nominees proposed for election to our boardthe Board of directorsDirectors are currently members of our boardthe Board and have previously been elected previously by our stockholders. The new nominee for election is Suzan F. Harrison. Ms. Harrison was identified by the Nominating/Corporate Governance Committee as a potential nominee and was recommended by the Nominating/Corporate Governance Committee after it completed its interview and vetting process. Unless you provide different directions, we intend forboard-solicited proxies (like this one) to be voted for the nominees named below.

If elected, the nominees would hold office until the next annual stockholders’ meeting and until their successors are elected and qualified. If any nominee for director becomes unable to serve as a director, the persons named in the proxyas proxies may vote for a substitute who will be designated by the boardBoard of directors.Directors. Alternatively, the boardBoard of directorsDirectors could reduce the size of the board. The boardBoard has no reason to believe that any nominee will be unable to serve as a director. Our bylaws require that each director be elected by a majority of votes cast with respect to that director in an uncontested election (where the number of nominees is the same as the number of directors to be elected). In a contested election (where the number of nominees exceeds the number of directors to be elected), the plurality voting standard governs the election of directors. Under the plurality standard, the number of nominees equal to the number of directors to be elected who receive more votes than the other nominees are elected to the board,Board, regardless of whether they receive a majority of the votes cast. Whether an election is contested or not is determined as of the day before we first mail our meeting notice to stockholders. This year’s election was determined to be an uncontested election, and the majority vote standard will apply. If a nominee who is serving as a director is not elected at the annual meeting, Delaware law provides that the director would continue to serve on the boardBoard as a “holdover director.” However, under our Corporate Governance Guidelines, each director annually submits an advance, contingent, irrevocable resignation that the boardBoard may accept if the director fails to be elected through a majority vote in an uncontested election. In that situation, the Nominating/Corporate Governance Committee would make a recommendation to the boardBoard about whether to accept or reject the resignation. The boardBoard will act on the Nominating/Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days after the date the election results are certified. The boardBoard will nominate for election orre-election as director, and will elect as directors to fill vacancies and new directorships, only candidates who agree to tender the form of resignation described above. If a nominee who was not already serving as a director fails to receive a majority of votes cast at the annual meeting, Delaware law provides that the nominee does not serve on the boardBoard as a “holdover director.” The information below describes the nominees, their ages, positions with our company, principal occupations, current directorships of other publicly-ownedpublicly owned companies, directorships of other publicly-ownedpublicly owned companies held within the past five years, the year in which each first was elected as a director, and the number of shares of common stock beneficially owned as of March 13, 2017,16, 2020, directly or indirectly. Unless otherwise indicated, and subject to community property laws where applicable, we believe that each nominee named in the table below has sole voting and investment power with respect to the shares indicated as beneficially owned. Unless otherwise indicated, all of the nominees have been executive officers of their respective companies or employed as otherwise specified below for at least the last five years. The Board of Directors recommends a vote FOR the election of the eleven nominees named below as directors. Proxies solicited by the Board will be so voted unless stockholders specify a different choice. | | | 6ADM Proxy Statement 2020 | | ADM Proxy Statement 20177 |

PROPOSAL NO.Proposal No. 1 — Election of Directors for a One-Year Term

Director Nominees ELECTION OF DIRECTORS

DIRECTOR NOMINEES | | Alan L. BoeckmannMichael S. Burke

|

| | | | |  | | Age: 56 Director since: 2018 Common stock owned:6,862(1) Percent of class: * Age: 68

Director since: 2012

Common stock owned:35,694(1)

Percent of class: *

Former Principal Occupation or Position:Non-Executive Chairman of Fluor Corporation (an engineering and construction firm) from 2011 – February 2012; Chairman and Chief Executive Officer of AECOM (a global infrastructure firm) since March 2015; Chief

|

Executive Officer of Fluor CorporationAECOM from 2002 – 2011.March 2014 to March 2015; President of AECOM from 2011 to March 2014. Directorships of Other Publicly-Owned Companies: DirectorChairman of Sempra Energy and BP p.l.c.AECOM. Qualifications and Career Highlights: Prior to retiring in February 2012, Mr. Boeckmann served in a variety of engineeringBurke is currently Chief Executive Officer and executive management positions during his35-plus year career with Fluor Corporation, includingnon-executive Chairman of the Board from 2011of AECOM, an infrastructure firm that designs, builds, finances, and operates infrastructure assets in more than 150 countries. Mr. Burke joined AECOM in October 2005 and has held several leadership positions, including Senior Vice President, Corporate Strategy, Chief Corporate Officer, and Chief Financial Officer. Prior to February 2012, Chairman ofjoining AECOM, Mr. Burke was with the accounting firm KPMG LLP, serving in various leadership positions. Mr. Burke brings to the Board of Directors his deep expertise in accounting and Chief Executive Officer from 2002 to 2011, and President and Chief Operating Officer from 2001 to 2002. His tenure with Fluor Corporation included responsibility for global operations and multiple international assignments. Mr. Boeckmann currently servesfinance, his experience as a director of Sempra EnergyCEO, and BP p.l.c. He has previously served onhis involvement in projects throughout the boards of BHP Billiton and Burlington-Northern Santa Fe. Mr. Boeckmann has been an outspoken business leader in promoting international standards for business ethics. His extensive board and executive management experience, coupled with his commitment to ethical conduct in international business activities, makes him a valuable addition to our board of directors.world.

| | Terrell K. CrewsPierre Dufour

|

Age: 61

Director since: 2011

Common stock owned: 21,256(2)

Percent of class: *

Former Principal Occupation or Position: Executive Vice President, Chief Financial Officer and Vegetable Business Chief Executive Officer of Monsanto Company (an agricultural company) from 2007 – 2009.

Directorships of Other Publicly-Owned Companies:Director of WestRock Company and Hormel Foods Corporation; Director of Rock-Tenn Company within the past five years.

Qualifications and Career Highlights:

Mr. Crews retired from Monsanto Company in 2009. He served as Executive Vice President, Chief Financial Officer and Vegetable Business CEO for Monsanto Company from 2007 to 2009, and Executive Vice President and Chief Financial Officer from 2000 to 2007. Mr. Crews brings to our board of directors extensive expertise in finance and related functions, as well as significant knowledge of corporate development, agri-business and international operations.

| | | ADM Proxy Statement 2017 | |  | | 7 |

PROPOSAL NO. 1 —ELECTION OF DIRECTORS

| Age: 64 Pierre DufourDirector since: 2010

Common stock owned:30,285(3) Percent of class: * Former Principal Occupation or Position: Senior Executive Vice President of Air Liquide Group (a leading provider of gases for industry, health, and |

Age: 61

Director since: 2010

Common stock owned: 28,668(3)

Percent of class: *

Principal Occupation or Position: Senior Executive Vice President of Air Liquide Group (a leading provider of gases for industry, health and the environment) since 2007.from 2007 – July 2017.

Directorships of Other Publicly-Owned Companies: Director of Air Liquide S.A. andDirector of National Grid plc. within the past five years. Qualifications and Career Highlights: Prior to retiring in July 2017, Mr. Dufour isserved as Senior Executive Vice President of Air Liquide Group, the world leader in gases for industry, health, and the environment. Having joined Air Liquide in 1997, Mr. Dufour was named Senior Executive Vice President in 2007. Since 2010, he has supervisedMr. Dufour’s tenure with Air Liquide’sLiquide Group included supervision of operations in the Americas, Africa-Middle East, and Asia-Pacific zones, whileand he also overseeing, globally,was responsible for Air Liquide’s industrial World Business Lines, Engineering and Construction. Mr. Dufour was elected to the board of Air Liquide S.A. in May 2012. Mr. Dufour’s qualifications to serve as a director of our company include his substantial leadership, engineering, operations management, and international business experience. | | | | |  | | Donald E. FelsingerAge: 64

Director since: 2011 Common stock owned:35,608(2) Percent of class: * Former Principal Occupation or Position: Executive Vice President, Chief Financial Officer and Vegetable Business Chief Executive Officer of |

Age: 69

Director since: 2010

Common stock owned: 40,989(1)

Percent of class: *

Former Principal Occupation or Position: Executive Chairman of Sempra EnergyMonsanto Company (an energy servicesagricultural company) from 20112007 – December 2012.2009.

Directorships of Other Publicly-Owned Companies:Director of WestRock Company and Hormel Foods Corporation. Qualifications and Career Highlights: Mr. Crews retired from Monsanto Company in 2009. He served as Executive Vice President, Chief Financial Officer and Vegetable Business CEO for Monsanto Company from 2007 to 2009, and Executive Vice President and Chief Financial Officer from 2000 to 2007. Mr. Crews brings to the Board of Directors extensive expertise in finance and related functions, as well as significant knowledge of corporate development, agri-business, and international operations. | | | | |  | | Age: 72 Director since: 2009 Common stock owned: 126,676(4) Percent of class: * Former Principal Occupation or Position: Executive Chairman of Sempra Energy (an energy services company) from 2011 – December 2012. |

Directorships of Other Publicly-Owned Companies:Lead Director of Northrop Grumman Corporation andCorporation. Director of Gannett Co., Inc. within the past five years. Qualifications and Career Highlights: Mr. Felsinger brings extensive experience as a board member, chair and CEO with Fortune 500 companies. Mr. Felsinger retired as Executive Chairman of Sempra Energy in December 2012. His leadership roles at Sempra Energy and other companies have allowed him to provide our boardthe Board of directorsDirectors with his expertise in mergers and acquisitions, environmental matters, corporate governance, strategic planning, engineering, finance, human resources, compliance, risk management, international business, and public affairs. | | | | 8 | | ADM Proxy Statement 20172020 |

PROPOSAL NO.Proposal No. 1 —ELECTION OF DIRECTORS

Election of Directors for a One-Year TermDirector Nominees | | | | |  | | Age: 62 Director since: 2017 Common stock owned:10,893(1) Percent of class: * Former Principal Occupation or Position: President of Global Oral Care at Colgate-Palmolive Company (a global household and consumer |

Age: 59

Director since: –

Common stock owned: 0

Percent of class: *

Principal Occupation or Position: President of Global Oral Care at Colgate-Palmolive Company (a global household and consumer products company) since 2011;from 2011 – 2019; President of Hill’s Pet Nutrition Inc. North America from 2009 – 2011; Vice President, Marketing for Colgate U.S. from 2006 – 2009; Vice President and General Manager2009.

Directorships of Colgate Oral Pharmaceuticals, North America and Europe from 2005 – 2006.Other Publicly-Owned Companies:Director of WestRock Company. Qualifications and Career Highlights: Ms. Harrison is currentlyretired in 2019 as the President of Global Oral Care at Colgate-Palmolive Company, a worldwide consumer products company focused on the production, distribution, and provision of household, health care, and personal products. She was previously President of Hill’s Pet Nutrition Inc. North America, a position she held from 2009 to 2011. Additionally, she served as Vice President, Marketing for Colgate U.S. from 2006 to 2009, and Vice President and General Manager of Colgate Oral Pharmaceuticals, North America and Europe from 2005 to 2006. Previously, Ms. Harrison held a number of leadership roles at Colgate commencing in 1983. Ms. Harrison’s qualifications to serve as a director of our company include her extensive leadership, management, operations, marketing, and international experience. | | | | |  | | Age: 65 Director since: 2003 Common stock owned:64,497(1) Percent of class: * Principal Occupation or Position: President and Chief Executive Officer of PJM Advisors, LLC (an investment and advisory firm) since 2011; Chief |

Executive Officer of Smurfit-Stone Container Corporation from

2010 – 2011(6). Directorships of Other Publicly-Owned Companies: Chairman of Energizer Holdings, Inc. Qualifications and Career Highlights: Mr. Moore retired as Chief Executive Officer of Smurfit-Stone Container Corporation in 2011, and held positions of increasing importance at Smurfit-Stone and related companies since 1987. Prior to 1987, Mr. Moore served 12 years at Continental Bank in various corporate lending, international banking, and administrative positions. Mr. Moore brings to the Board of Directors his substantial experience in leadership, banking and finance, strategy development, sustainability, and operations management. | | | | |  | | Age: 58 Director since: 2014 Common stock owned:2,777,280 (5) Percent of class: * Principal Occupation or Position: Chairman of the Board, Chief Executive Officer and President since January 2016; Chief Executive Officer and |

Age: 55

Director since:President from January 2015

Common stock owned: 1,510,138(4)

Percent of class: *

Principal Occupation or Position: Chairman of the Board, Chief Executive Officer and President since - January 2016; Chief Executive Officer and President since January 2015; President and Chief Operating Officer from February 2014 – December 2014; Executive Vice President and Chief Operating Officer from 2011 – February 2014.

Directorships of Other Publicly-Owned Companies:Director of Eli Lilly and Company and Wilmar International Limited.Company. Qualifications and Career Highlights: Mr. Luciano joined ADM in 2011 as executive vice president and chief operating officer, was named president in February 2014, was named Chief Executive Officer effectivein January 2015, and was named Chairman of the Board effectivein January 2016. Mr. Luciano has overseen the commercial and production activities of ADM’s Corn, Oilseeds, and Agricultural Services businesses, as well as its research, project management, procurement, and risk management functions. He also has also overseen the company’s operational excellence initiatives, which seek to improve productivity and efficiency companywide. He has led the company’s efforts to improve its capital, cost, and cash positions. Previously, Mr. Luciano was with The Dow Chemical Company, where he last served as executive vice president and president of the performance division. | | | ADM Proxy Statement 2017 | |  | | 9 |

PROPOSAL NO. 1 —ELECTION OF DIRECTORS

| Age: 60 Patrick J. MooreDirector since: 2014

Common stock owned:25,587(7) Percent of class: * Principal Occupation or Position: Senior Managing Director of Pt. Capital (a private equity firm) and Chairman of CNS Global Advisors (an |

Age: 62

Director since: 2003

Common stock owned: 47,279(1)

Percent of class: *

Principal Occupation or Position: President and Chief Executive Officer of PJM Advisors, LLC (an investment and advisory firm) since 2011; Chief Executive Officer ofSmurfit-Stone Container Corporation from 2010 – 2011(5).

Directorships of Other Publicly-Owned Companies:Director of Energizer Holdings, Inc.; Director of Rentech Inc., Exelis, Inc. and Ralcorp Holdings, Inc. within the past five years.

Career Highlights:

Mr. Moore retired as Chief Executive Officer of Smurfit-Stone Container Corporation in 2011, and held positions of increasing importance at Smurfit-Stone and related companies since 1987. Prior to 1987, Mr. Moore served 12 years at Continental Bank in various corporate lending, international banking and administrative positions. Mr. Moore brings to our board of directors his substantial experience in leadership, banking and finance, strategy development, sustainability and operations management.

Age: 57

Director since: 2014

Common stock owned: 12,444(6)

Percent of class: *

Principal Occupation or Position: Senior Managing Director of Pt. Capital (a private equity firm) and Chairman of CNS Global Advisors (an international trade and investment consulting firm) since November 2013; Under Secretary for International Trade, U.S. Department of Commerce from 2010 – November 2013.

Directorships of Other Publicly-Owned Companies: Director of Good Resources Holdings Ltd. within the past five years. Qualifications and Career Highlights: Mr. Sanchez is the founder and chairman of the board of CNS Global Advisors, a firm focused on international trade and investment. In addition, he is a Senior Managing Director at Pt. Capital, a private equity firm focused on responsible investments in the Pan Arctic. In 2009, President Obama nominated Mr. Sanchez to be the Under Secretary for International Trade at the U.S. Department of Commerce. He was later unanimously confirmed by the U.S. Senate. Mr. Sanchez served in that role until November 2013. There he was responsible for strengthening the competitiveness of U.S. industry, promoting trade and investment, enforcing trade laws and agreements, and implementing the President’s National Export Initiative. Mr. Sanchez brings to our boardthe Board of directorsDirectors substantial experience in public policy, international trade, and international investment. | | | 10ADM Proxy Statement 2020 | | ADM Proxy Statement 20179 |

PROPOSAL NO.Proposal No. 1 —ELECTION OF DIRECTORS Election of Directors for a One-Year Term

Director Nominees | | | | |  | | Age:60 Director since: 2016 Common stock owned:14,681(1) Percent of class: * Principal Occupation or Position: President of LaGrenade Group, LLC (a marketing consulting firm) since October 2015; Chief Health and |

Age: 57

Director since: 2016

Common stock owned: 2,279(1)

Percent of class: *

Principal Occupation or Position: President of LaGrenade Group, LLC (a marketing consulting firm) since October 2015; Chief Health and Wellbeing Officer of Mars, Inc. from July 2014 – July 2015; President, Chocolate, North America of Mars, Inc. from April 2012 – July 2014; Chief Consumer Officer of Mars Chocolate North America from 2009 – March 2012.

Directorships of Other Publicly-Owned Companies: Director of Gannett Co., Inc. Qualifications and Career Highlights: Ms. Sandler is currently President of LaGrenade Group, LLC, a marketing consultancy she founded to advise consumer packaged goods companies operating in the Health and Wellness space. She was previously Chief Health and Wellbeing Officer of Mars, Inc., a position she held from July 2014 to July 2015. Additionally, she served as President, Chocolate, North America from April 2012 to July 2014;2014, and Chief Consumer Officer, Mars Chocolate North America from November 2009 to March 2012. Prior to joining Mars, Ms. Sandler spent 10 years with Johnson & Johnson in a variety of leadership roles. She currently serves on the board of Gannett Co., Inc. Ms. Sandler has strong marketing and operating experience and a proven record of creating, building, enhancing, and leading well-known consumer brands as a result of the leadership positions she has held with Mars, Johnson & Johnson, and PepsiCo. Age: 65

Director since: 2012

Common stock owned: 15,033(1)

Percent of class: *

Former Principal Occupation or Position: Deputy Chairman, Executive Director and Chief Strategy Officer of Stella International Holdings Limited (a developer and manufacturer of footwear) from 2008 – August 2013.

Qualifications and Career Highlights:

Mr. Shih served as Deputy Chairman, Executive Director and Chief Strategy Officer of Stella International Holdings Limited, a company listed on the Main Board of the Hong Kong Stock Exchange, from 2008 to August 2013. He previously held executive positions with PepsiCo (China) Investment Ltd. and Motorola (China) Electronic Ltd. Mr. Shih’s qualifications to serve as a director of the company include his extensive business experience in Asia and his expertise in business strategy, leadership development, joint ventures and mergers and acquisitions.

| | | ADM Proxy Statement 2017 | | 11 |

PROPOSAL NO. 1 —ELECTION OF DIRECTORS

| | | | |  | | Age: 64 Director since: 2003 Common stock owned:47,641(1) Percent of class: * Principal Occupation or Position: President and Chief Executive Officer of KRW Advisors, LLC (a consulting and advisory firm) since 2007; |

Age: 61

Director since: 2003

Common stock owned: 45,930(1)

Percent of class: *

Principal Occupation or Position: President and Chief Executive Officer of KRW Advisors, LLC (a consulting and advisory firm) since 2007; Chairman and Chief Strategic Officer of Millennium Digital Media Systems, L.L.C. (a broadband services company) (“MDM”)(7)(8) from 2006 – 2007; President and Chief Executive Officer of Millennium Digital Media, L.L.C. from 1997 – 2006.2007.

Directorships of Other Publicly-Owned Companies:Director of Stifel Financial Corp.,T-Mobile USA, Inc. and Mosaic Company andCompany; Lead Independent Trust Manager of Camden Property Trust. Director of Stifel Financial Corp. within the past five years. Qualifications and Career Highlights: Mr. Westbrook brings legal, media, and marketing expertise to the boardBoard of directors.Directors. He is a former partner of a national law firm, was the President, Chief Executive Officer, andco-founder of two large cable television and broadband companies, and was or is a member of the board of numerousseveral high-profile companies, includingT-Mobile USA, Inc. and the National Cable Satellite Corporation, better known asC-SPAN. Mr. Westbrook currently servesalso previously served on the boardsboard of four other public companies and a multi-billion dollarmulti-billion-dollar not-for-profit healthcare services company. | | | | |  | | Age: 53 Director since: 2019 Common stock owned:3,137(1) Percent of class: * Principal Occupation or Position: Executive Vice President, Automotive OEM at Illinois Tool Works Inc. (a global multi-industrial manufacturer) since |

January 2020; Executive Vice President, Food Equipment at Illinois Tool Works from September 2015 – January 2020; Group President, Worldwide Ware-Wash, Refrigeration, and Weigh/Wrap Businesses at Illinois Tool Works from 2011 – December 2015; Vice President, Research & Development, and Head of ITW Technology Center at Illinois Tool Works from 2008 – 2011. Qualifications and Career Highlights: Dr. Schlitz is currently Executive Vice President of the Automotive OEM segment at Illinois Tool Works Inc., a publicly held, global multi-industrial manufacturer. She oversees a global business involving the design and manufacture of fasteners, interior and exterior components, and powertrain and braking systems for automotive OEMs and theirtop-tier suppliers around the world. Previously, she has served in leadership roles at Illinois Tool Works, serving as Executive Vice President of the Food Equipment segment, a global commercial food equipment business, serving institutional, industrial, restaurant, and retail customers around the world, and the group president of various food equipment businesses and leading research and development efforts. Dr. Schlitz brings extensive leadership experience in strategy development, growth initiatives, and operational excellence. | | | | 10 | | ADM Proxy Statement 2020 |

Proposal No. 1 — Election of Directors for a One-Year Term Director Experiences, Qualifications, Attributes, and Skills; Board Diversity * Less than 1% of outstanding shares (1) Consists of stock units allocated under our Stock Unit Plan for Nonemployee Directors that are deemed to be the equivalent of outstanding shares of common stock for valuation purposes. (2) Includes 20,49634,848 stock units allocated under our Stock Unit Plan. (3) Includes 22,585 stock units allocated under our Stock Unit Plan. (4) Includes 66,676 stock units allocated under our Stock Unit Plan for Nonemployee Directors.and 60,000 shares held in trust. (3)(5) Includes 20,968 stock units allocated under our Stock Unit Plan for Nonemployee Directors.

(4) Includes 275,059440,574 shares held in trust, 238 shares held by afamily-owned limited liability company, and 865,4781,766,494 shares that are unissued but are subject to stock options exercisable within 60 days.

(5)(6) Smurfit-Stone Container Corporation and its U.S. and Canadian subsidiaries filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in January 2009.

(6)(7) Includes 9,44421,217 stock units allocated under our Stock Unit Plan for Nonemployee Directors.Plan.

(7)(8) Broadstripe, LLC (formerly MDM) and certain of its affiliates filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in January 2009, approximately fifteen months after Mr. Westbrook resigned from MDM.

Director Experiences, Qualifications, Attributes and Skills, and Board DiversityDIRECTOR EXPERIENCES, QUALIFICATIONS, ATTRIBUTES, AND SKILLS; BOARD DIVERSITY

In assessing an individual’s qualifications to become a member of the board,Board, the Nominating/Corporate Governance Committee may consider various factors including education, experience, judgment, independence, integrity, availability, and other factors that the Committee deems appropriate. The Nominating/Corporate Governance Committee strives to recommend candidates that complement the current board members and other proposed nominees so as to further the objective of having a board that reflects a diversity of background and experience with the necessary skills to effectively perform the functions of the boardBoard and its committees. In addition, the Committee considers personal characteristics of nominees and current board members, including race, gender, and geographic origin, in an effort to obtain a diversity of perspectives on the board.Board. The specific experience, qualifications, attributes, and skills that qualify each of our directors to serve on our boardthe Board are described in the biographies above.above and in the Proxy Summary under “Director Nominee Qualifications and Experience” on page 3 and “Director Nominee Diversity, Age, Tenure, and Independence” on page 4. Director Nominations from StockholdersDIRECTOR NOMINATIONS FROM STOCKHOLDERS

The Nominating/Corporate Governance Committee will consider nominees recommended by a stockholder, provided that the stockholder submits the nominee’s name in a written notice delivered to our Secretary at our principal executive offices not less than 60 nor more than 90 days prior to the anniversary date of the immediately preceding annual stockholders’ meeting. However, if the annual meeting is called for a date that is not within 30 days before or after such anniversary date, the notice must be received at our principal executive offices not later than the close of business on the tenth day following the day on which such notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made (whichever first occurs). Different notice delivery requirements may apply if the number of directors to be elected at an annual meeting is being increased, and we do not make a public announcement naming all of the nominees or specifying the size of the increased board at least 100 days prior to the first anniversary of the preceding year’s annual meeting. Any notice of a stockholder nomination must set forth the information required by Section 1.4(c) of our bylaws, and must be accompanied by a written consent from the proposed nominee to being named as a nominee and to serve as a director if elected, a written representation and agreement from the proposed nominee attesting to certain facts set forth in Section 1.4(c)(2) of our bylaws, and a written statement from the proposed nominee as to whether he or she intends, if elected, to tender the advance, contingent, irrevocable resignation that would become effective should the individual fail to receive the required vote forre-election at the next meeting of stockholders. Stockholders may also have the opportunity to include nominees in our proxy statement by complying with the requirements set forth in Section 1.15 of our bylaws. All candidates, regardless of the source of their recommendation, are evaluated using the same criteria. | | | 12ADM Proxy Statement 2020 | | ADM Proxy Statement 201711 |

BOARD LEADERSHIP AND OVERSIGHTBoard Leadership and Oversight

BOARD LEADERSHIP STRUCTUREBoard Leadership Structure

Our company’s boardBoard of directorsDirectors does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated, because the boardBoard believes it is in the best interest of our company to make this determination based on the position and direction of the company and the constitution of the boardBoard and management team. The boardBoard regularly evaluates whether the roles of Chief Executive Officer and Chairman of the Board should be combined or separated. The board’s recentBoard’s implementation of a careful and seamless succession plan over the past several years demonstrates that the boardBoard takes seriously its responsibilities under the Corporate Governance Guidelines to determine who should serve as Chairman at any point in time in light of the specific circumstances facing our company. After careful consideration, the Board has determined that having Mr. Luciano, our company’s Chief Executive Officer, serve as Chairman effective January 1, 2016, is in the best interest of our stockholders at this time. The Chief Executive Officer is responsible for theday-to-day management of our company and the development and implementation of our company’s strategy, and has access to the people, information, and resources necessary to facilitate board function. Therefore, the boardBoard believes at this time that combining the roles of Chief Executive Officer and Chairman contributes to an efficient and effective board. Thenon-management independent directors elect a Lead Director at the board’sBoard’s annual meeting. Mr. Felsinger is currently serving as Lead Director. The boardBoard believes that having an independent Lead Director provides the boardBoard with independent leadership and facilitates the independence of the boardBoard from management. The Nominating/Corporate Governance Committee regularly evaluates the responsibilities of the Lead Director and considers current trends regarding independent board leadership. In the last few years, the Board has enhanced the Lead Director’s responsibilities, as set forth in the Corporate Governance Guidelines, in connection with determining performance criteria for evaluating the Chief Executive Officer, evaluating the Board, committees, and individual directors, and planning for management succession. In accordance with our Corporate Governance Guidelines, the Lead Director: (i) presides at all meetings of the boardBoard at which the Chairman is not present, including executive sessions of the independent directors, and regularly meets with the Chairman and Chief Executive Officer for discussion of appropriate matters arising from these sessions; (ii) coordinates the activities of the other independent directors and serves as liaison between the Chairman and the independent directors; (iii) consults with the Chairman and approves all meeting agendas, schedules, and information provided to the board;Board, and may, from time to time, invite corporate officers, other employees, and advisors to attend Board or committee meetings whenever deemed appropriate; (iv) interviews, along with the Chairman and the Chair and members of the Nominating/Corporate Governance Committee, all director candidates and makes recommendations to the Nominating/Corporate Governance Committee; (v) advises the Nominating/Corporate Governance Committee on the selection of members of the board committees; (vi) advises the board committees on the selection of committee chairs; (vii) works with the Chairman and Chief Executive Officer to propose a schedule of major discussion items for the board;Board; (viii) guides the board’sBoard’s governance processes; (ix) provides leadership to the boardBoard if circumstances arise in which the role of the Chairman or Chief Executive Officer may be, or may be perceived to be, in conflict; (x) has the authority to call meetings of the independent directors; (xi) if requested by major stockholders, ensures that he or she is available for consultation and direct communication; (xii) leads thenon-management directors in determining performance criteria for evaluating the Chief Executive Officer and coordinates the annual performance review of the chief executive officer;Chief Executive Officer; (xiii) works with the Chair of the Compensation/Succession Committee to guide the Board’s discussion of management succession plans; (xiv) works with the Chair and (xiii)members of the Nominating/Corporate Governance Committee to facilitate the evaluation of the performance of the Board, committees, and individual directors; (xv) works with the Chair and members of the Sustainability and Corporate Responsibility Committee to set sustainability and corporate responsibility objectives; and (xvi) performs such other duties and responsibilities as the boardBoard may determine. In addition to electing a Lead Director, ournon-management independent directors facilitate the board’sBoard’s independence by meeting frequently as a group and fostering a climate of transparent communication. The high level of contact between our Lead Director and our Chairman between board meetings and the specificity contained in the board’sBoard’s delegation of authority parameters also serve to foster effective board leadership. | | | | 12 | | ADM Proxy Statement 2020 |

Board Leadership and Oversight Board Role in Risk Oversight BOARD ROLE IN RISK OVERSIGHTBoard Role in Risk Oversight

Management is responsible forday-to-day risk assessment and mitigation activities, and our company’s boardBoard of directorsDirectors is responsible for risk oversight, focusing on our company’s overall risk management strategy, our company’s degree of tolerance for risk, and the steps management is taking to manage our company’s risks. While the boardBoard as a whole maintains the ultimate oversight responsibility for risk management, the committees of the boardBoard can be assigned responsibility for risk management oversight of specific areas. The Audit Committee currently maintains responsibility for overseeing our company’s enterprise risk management process and regularly discusses our company’s major risk exposures, the steps management has taken to monitor and control such exposures, and guidelines and policies to govern our company’s risk assessment and risk management processes. The Audit Committee periodically reports to our boardthe Board of directorsDirectors regarding significant matters identified with respect to the foregoing. | | | ADM Proxy Statement 2017 | | 13 |

BOARD LEADERSHIP AND OVERSIGHT

Management has established an IntegratedEnterprise Risk Management Committee consisting of a Chief Risk Officer and personnel representing multiple functional and regional areas within our company, with broad oversight of the risk management process. | | | | | | | | | | | | | | | | | | | | | BOARD OF DIRECTORS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Audit Committee • assists the boardBoard in fulfilling its oversight responsibility to the stockholders relating to the company’s major risk exposures • oversees the company’s enterprise risk management process • regularly discusses the steps management has taken to monitor and control risk exposure • regularly reports to the boardBoard regarding significant matters identified | | | | | | Nominating / Nominating/Corporate

Governance Committee • has authority to assignassigns oversight of specific areas of risk to other committees • recommends director nominees who it believes will capably assess and monitor risk | | | | | | Compensation /

Compensation/ Succession Committee

• assesses potential risks associated with compensation decisions • engages an independent outside consultant every other year to review the company’s compensation programs and evaluate the risks in such programsprograms; the consultant attends all committee meetings to advise the committee | | | | Sustainability and Corporate Responsibility Committee • has oversight responsibility for sustainability and corporate responsibility matters, including workplace safety, process safety, environmental, social well-being, diversity and inclusion, corporate giving, community relations, compliance with sustainability and corporate responsibility laws and regulations, and ADM’s performance relating to sustainability and corporate responsibility goals and industry benchmarks |

| | | | | | | | | | | | | | | | | | | SENIOR MANAGEMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | IntegratedEnterprise Risk Management Committee | • ensures implementation and maintenance of a process to identify, evaluate, and prioritize risks to achievement of our company’s objectives • ensures congruence of risk decisions with our company’s values, policies, procedures, measurements, and incentives or disincentives • supports the integration of risk assessment and controls into mainstream business processes, planning, and decision-making | | | | | | • identifies roles and responsibilities across our company in regard to risk assessment and control functions • promotes consistency and standardization in risk identification, reporting, and controls across our company • ensures sufficient information capabilities and information flow to support risk identification and controls and alignment of technology assets | | | | | | • regularly evaluates the overall design and operation of the risk assessment and control process, including development of relevant metrics and indicators • reports regularly to senior management and our boardthe Board regarding the above-described processes and the most significant risks to our company’s objectives |

| | | | ADM Proxy Statement 2020 | | 13 |

Board Leadership and Oversight Sustainability and Corporate Responsibility BOARD ROLE IN OVERSEEING POLITICAL ACTIVITIESSustainability and Corporate Responsibility

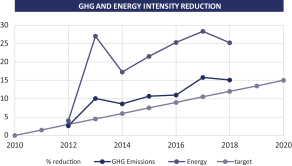

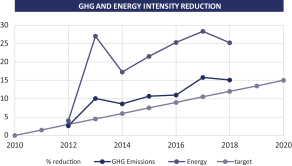

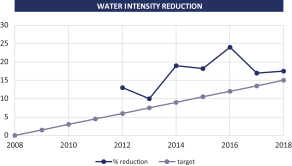

Our commitment to change and growth goes beyond our products and services. At ADM, sustainable practices and a focus on environmental responsibility are not separate from our primary business: they are integral to the work we do every day to serve customers and create value for stockholders. We have aligned our efforts with the United Nations (UN) Sustainable Development Goals which serve as a road map to achieve a better future for all. Specifically, we are focusing our efforts toward Zero Hunger, Clean Water and Sanitation, Climate Action, and Life On Land. Our sustainability efforts are led by our Chief Sustainability Officer, who is supported by regional sustainability teams. Sustainability-related risks are reviewed quarterly through the Enterprise Risk Management process. In 2019, our company’s Board of Directors created a Sustainability and Corporate Responsibility Committee. This committee has oversight of sustainability and corporate responsibility matters. Sustainability topics are also presented to the full Board. See the table below for additional information and highlights related to our sustainability efforts. | | | | SUSTAINABILITY HIGHLIGHTS | | Climate Action | | Clean Water and Sanitation | • We address climate change through three main pathways: • renewable product and process innovations, such as our carbon sequestration project in Decatur, Illinois, • supply chain commitments, such as our Commitment toNo-Deforestation, and • a strategic approach to operational excellence which emphasizes enhancing the efficiency of our production plants throughout our global operations, including through a centralized energy management team that enables us to identify and share successful programs across business or geographic regions. • See the charts below illustrating our progress toward our greenhouse gas emissions and energy intensity goals:

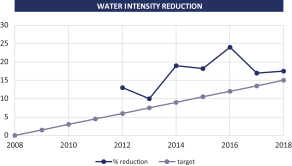

| | • We aim to conserve water and improve water quality through: • supply chain projects specifically focusing on water conservation and improving water quality, • water-reduction efforts and efficiency improvement projects in our own operations, which have resulted in a reduction of 2.6 billion gallons of water per year, and • the Ceres and World Wildlife Fund AgWater Challenge, through which we have set measurable, time-bound commitments to mitigate water risks, reduce water impacts associated with key commodities, and provide support and education to growers about water stewardship practices. • See the chart below illustrating our progress toward our water-reduction goals:

|

| | | | 14 | | ADM Proxy Statement 2020 |

Board Leadership and Oversight Board Role in Overseeing Political Activities | | | | Zero Hunger | | Life On Land | • We support the UN efforts to eliminate world hunger by connecting the harvest to the home: • with a vast and diverse global value chain that includes approximately 480 crop procurement locations, approximately 350 ingredient manufacturing facilities, approximately 55 innovation centers, and the world’s premier crop transportation network, • through our corporate social investment program, ADM Cares, which supports food security and hunger relief projects globally, • through sustainable sourcing, certification and sustainable agriculture programs across the globe, and • in 2019, through an ADM Cares grant, we committed $1M to help create and implement an18-month program to fight hunger for 50,000 people in Ethiopia and Kenya with a focus on women and children. | | • We are a responsible steward to our natural resources: • In 2015, we committed to no deforestation, no planting on peat, and no exploitation (No DPE) in our palm and South American soy supply chains through our Commitment toNo-Deforestation. • In Brazil, we remain committed to the Amazon Soy Moratorium, and in the Brazilian Cerrado, we have digitally mapped 100% of our direct supply chain in the 25 municipalities at the greatest risk for land conversion. • We report our progress with respect to our No DPE efforts to the public at www.adm.com/progresstracker. • Over 800,000 acres of our supply chain is involved in sustainable agriculture initiatives. • In Illinois, ADM supported the S.T.A.R. program for growers which tripled its enrollment goal in 2019. • We require all ADM colleagues and suppliers to comply with ADM’s Human Rights Policy. • In 2019, we completed a human rights risk assessment for our global commodity supply chains. | | For more information, please review our Corporate Sustainability Report, found at www.adm.com/sustainability. |

Board Role in Overseeing Political Activities The Board of Directors believes that participation in the political process is important to our business. ADMWe and itsour political action committee (ADMPAC) therefore support candidates for political office and organizations that share ourpro-growth vision, our aspirations for the future of global agriculture, and our commitment to the people who depend on it for their lives and livelihoods. Decisions to support particular candidates and/or organizations are subject to fixed policies and determined by the company’s best interests, not the personal political preferences of ADMour company’s executives. ADMPAC submits to the Federal Election Commission (FEC) regular, detailed reports on all federal political contributions, which reports are available to the public on the FEC’s website. Similarly, contributions to state candidates are disclosed to relevant state authorities and typically disclosed on individual states’ websites. In addition to ADM’sour contributions to individual candidates for public office and candidate committees, ADMwe also supportssupport a small number ofso-called “527” groups, including the Democratic Governors Association, the Republican Governors Association, Ag America, and the Republican State Leadership Committee. We have not supported independent political expenditures or 501(c)(4) organizations. Finally, ADM haswe have memberships in several industry, trade, and business associations representing agriculture and the business community. If a trade association engages in political activity, the amount of dues associated with this political advocacy is reported in ADM’sour quarterly LD2 filings. ADM engagesWe engage in a centralized, deliberative process when making decisions about the company’s political participation to ensure that it complies with all applicable laws and makes appropriate disclosures. Contributions of greater than $1,000 typically require the approval of the board of directors of ADMPAC, a political action committee funded by our employees’ voluntary contributions. The ADMPAC board of directors is chaired by the vice president of state government relations and composed of employees who represent various areas of the company. Contributions of less than $1,000 may be authorized by the company’s vice president of government relations and vice president of state government relations.

| | | 14 | | ADM Proxy Statement 2017 |

BOARD LEADERSHIP AND OVERSIGHT

ADM’sThe Board of Directors provides oversight of ADMPAC’s and the Company’scompany’s political activities, political contributions, and compliance with relevant laws. At each quarterly Boardboard meeting, ADM management provides the Board of Directors with a detailed report on our political contributions in the previous quarter. Any member of the Board may obtain further detailed information concerning political contributions, trade associations, compliance with federal and state laws, or any other related topic.

For more information on ADM’s political policies and activities, please seehttps://www.adm.com/en-US/company/Pages/USPoliticalContributions.aspx.our-company/us-political-contributions. | | | ADM Proxy Statement 20172020 | | 15 |

DIRECTOR EVALUATIONS; SECTION 16(a) REPORTING COMPLIANCEDirector Evaluations

BOARD, COMMITTEE AND DIRECTOR EVALUATIONSBoard, Committee, and Director Evaluations

The boardBoard believes that a robust annual evaluation process is a critical part of its governance practices. Accordingly, the Nominating/Corporate Governance Committee oversees an annual evaluation of the performance of the boardBoard of directors,Directors, each committee of the board,Board, and each individual director. The Nominating/Corporate Governance Committee approves written evaluation questionnaires which are distributed to each director. The results of each written evaluation are provided to, and compiled by, an outside firm. Individual directors are evaluated by their peers in a confidential process. Our Lead Director works with the Chair and members of the Nominating/Corporate Governance Committee to facilitate the evaluation of the performance of the Board, committees, and individual directors, and delivers and discusses individual evaluation results with each director and the chairdirector. The Chair of the Nominating/Corporate Governance Committee delivers and discusses the Lead Director’s individual evaluation with him or her. Results of the performance evaluations of the committees and the boardBoard are discussed at appropriate committee meetings and with the full board. Our boardThe Board utilizes the results of these evaluations in making decisions on board agendas, board structure, committee responsibilities and agendas, and continued service of individual directors on the board.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our directorsEvaluation questionnaires are distributed Outside firm collects results Results are delivered and executive officers to file reports of ownershipdiscussed with each director Other evaluations are discussed at committee meetings and changes in ownership on Forms 3, 4 and 5 with the SEC. Based on our review of Forms 3, 4 and 5 that we have received from, or have filed on behalf of, our directors and executive officers, and on written representations from those persons that they were not required to file a Form 5, we believe that, during the fiscal year ended December 31, 2016, our directors and executive officers complied with all Section 16(a) filing requirements.full board

| | | | 16 | | ADM Proxy Statement 20172020 |

INDEPENDENCE OF DIRECTORSIndependence of Directors

Independence of Directors INDEPENDENCE OF DIRECTORSThe Board of Directors has reviewed business and charitable relationships between our company and eachnon-employee director and director nominee to determine compliance with the NYSE standards and our bylaw standards, each described below, and to evaluate whether there are any other facts or circumstances that might impair a director’s or nominee’s independence. Based on that review, the Board has determined that ten of its eleven current members, Messrs. Burke, Crews, Dufour, Felsinger, Moore, Sanchez, and Westbrook, Ms. Harrison, Ms. Sandler, and Dr. Schlitz are independent. Mr. Luciano is not independent under the NYSE or bylaw standards because of his employment with us.

In determining that Mr. Burke is independent, the Board considered that, in the ordinary course of business, AECOM, of which Mr. Burke is Chairman and Chief Executive Officer, sold certain services to our company and purchased various products from our company on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of AECOM’s consolidated gross revenues, that Mr. Burke does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Mr. Burke’s independence. In determining that Mr. Crews is independent, the Board considered that, in the ordinary course of business, WestRock Company, of which Mr. Crews is a director, purchased various products from our company and sold various products to our company and that Hormel Foods Corporation, of which Mr. Crews is a director, purchased certain commodity products from our company, all on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that these arrangements did not exceed the NYSE’s threshold of 2.0% of WestRock Company’s or Hormel Foods Corporation’s consolidated gross revenues, respectively, that Mr. Crews does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Mr. Crews’ independence. In determining that Mr. Dufour is independent, the Board considered that, in the ordinary course of business, Air Liquide Group, of which Mr. Dufour is a director, sold certain chemicals to our company on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of Air Liquide Group’s consolidated gross revenues, that Mr. Dufour does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Mr. Dufour’s independence. In determining that Ms. Harrison is independent, the Board considered that, in the ordinary course of business, WestRock Company, of which Ms. Harrison is a director, purchased various products from our company and sold various products to our company, and that Colgate-Palmolive Company, of which Ms. Harrison was President of Global Oral Care until her retirement in 2019, purchased certain products from our company, all on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that these arrangements did not exceed the NYSE’s threshold of 2.0% of WestRock Company’s or Colgate-Palmolive Company’s consolidated gross revenues, that Ms. Harrison does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Ms. Harrison’s independence. In determining that Ms. Sandler is independent, the Board considered that, in the ordinary course of business, Gannett Co. Inc., of which Ms. Sandler is a director, sold certain products to our company on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of Gannett Co. Inc.’s consolidated gross revenues, that Ms. Sandler does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Ms. Sandler’s independence. In determining that Dr. Schlitz is independent, the Board considered that, in the ordinary course of business, Illinois Tool Works Inc., of which Dr. Schlitz is Executive Vice President, Automotive OEM, sold certain equipment and services to our company on anarm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of Illinois Tool Works Inc.’s consolidated gross revenues, that Dr. Schlitz does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Dr. Schlitz’s independence. In determining that Mr. Westbrook is independent, the Board considered that, in the ordinary course of business, Mosaic Company, of which Mr. Westbrook is a director, sold fertilizer products to our company and purchased certain logistics and other services from our company and thatT-Mobile US, Inc., of which Mr. Westbrook is a director, sold various products to our company, all on an | | | | ADM Proxy Statement 2020 | | 17 |

Independence of Directors Independence of Directors arm’s-length basis during the fiscal year ended December 31, 2019. The Board determined that these arrangements did not exceed the NYSE’s threshold of 2.0% of Mosaic Company’s orT-Mobile US, Inc.’s consolidated gross revenues, respectively, that Mr. Westbrook does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Mr. Westbrook’s independence. The listing standards of the New York Stock Exchange, or NYSE, require companies listed on the NYSE to have a majority of “independent” directors. Subject to certain exceptions and transition provisions, the NYSE standards generally provide that a director will qualify as “independent” if the boardBoard affirmatively determines that he or she has no material relationship with our company other than as a director, and will not be considered independent if: | 1. | the director or a member of the director’s immediate family is, or in the past three years has been, one of our executive officers or, in the case of the director, one of our employees; |

| 2. | the director or a member of the director’s immediate family has received during any12-month period within the last three years more than $120,000 per year in direct compensation from us other than for service as a director, provided that compensation received by an immediate family member for service as anon-executive officer employee is not considered in determining independence; |

| 3. | the director or an immediate family member is a current partner of one of our independent auditors, the director is employed by one of our independent auditors, a member of the director’s immediate family is employed by one of our independent auditors and personally works on our audits, or the director or a member of the director’s immediate family was within the last three years an employee of one of our independent auditors and personally worked on one of our audits; |

| 4. | the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where one of our executive officers at the same time serves or served on the compensation committee; or |

| 5. | the director is a current employee of, or a member of the director’s immediate family is an executive officer of, a company that makes payments to, or receives payments from, us in an amount which, in any of the of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues. |

The board of directors has reviewed business and charitable relationships between us and eachnon-employee director and director nominee to determine compliance with the NYSE standards described above and our bylaw standards described below and to evaluate whether there are any other facts or circumstances that might impair a director’s or nominee’s independence. Based on that review, the board has determined that eleven of its twelve current members, Messrs. Boeckmann, Crews, Dufour, Felsinger, Maciel, Moore, Sanchez, Shih and Westbrook, Ms. Carter and Ms. Sandler, are independent and that Ms. Harrison, a director nominee, is also

independent. Mr. Luciano is not independent under the NYSE or bylaw standards because of his employment with us.

In determining that Mr. Boeckmann is independent, the board considered that, in the ordinary course of business, Sempra Energy sold utility services to our company and BP p.l.c. sold natural gas and fuel to our company, all on anarm’s-length basis during the fiscal year ended December 31, 2016. Mr. Boeckmann is a director of Sempra Energy and BP. The board determined that Mr. Boeckmann does not have a direct or indirect material interest in such transactions and that such transactions do not impair Mr. Boeckmann’s independence.

In determining that Ms. Carter is independent, the board considered that, during the fiscal year ended December 31, 2016, the company purchased utility services from Westar Energy Inc. in the ordinary course of business and on anarm’s-length basis. Ms. Carter is a director of Westar Energy Inc. The board determined that Ms. Carter does not have a direct or indirect material interest in such utility transactions, and that such utility transactions do not impair Ms. Carter’s independence. The board further considered that, Norvell Company, of which Ms. Carter’s brother is majority owner, sold certain equipment having an aggregate purchase price less than $1.0 million, to our company, in the ordinary course of business, and on anarm’s-length basis. The board determined that Ms. Carter does not have a direct or indirect material interest in such transactions and that such transactions do not impair Ms. Carter’s independence.

In determining that Mr. Crews is independent, the board considered that, in the ordinary course of business, WestRock Company, of which Mr. Crews is a director, sold certain supplies to our company and that Hormel Foods Corporation, of which Mr. Crews is a director, purchased certain commodity products from our company, all on anarm’s-length basis during the fiscal year ended December 31, 2016. The board determined that Mr. Crews does not have a direct or indirect material interest in such transactions and that such transactions do not impair Mr. Crews’ independence.

In determining that Mr. Dufour is independent, the board considered that, in the ordinary course of business, Air Liquide Group, of which Mr. Dufour is Senior Executive Vice President and a director, sold certain supplies and commodity products to our company on anarm’s-length basis during the fiscal year ended December 31, 2016. The board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of Air Liquide Group’s consolidated gross revenues, that Mr. Dufour does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Mr. Dufour’s independence.

In determining that Mr. Maciel is independent, the board considered that, in the ordinary course of business, Marfrig Frigorificos, of which Mr. Maciel is a director, purchased various products from our

| | | ADM Proxy Statement 2017 | | 17 |

INDEPENDENCE OF DIRECTORS

company, all on anarm’s-length basis during the fiscal year ended December 31, 2016. The board determined that Mr. Maciel does not have a direct or indirect material interest in such transactions and that such transactions do not impair Mr. Maciel’s independence.

In determining that Mr. Sanchez is independent, the board considered that, during the fiscal year ended December 31, 2016, the company made a charitable contribution to H. L. Moffitt Cancer Center and Research Institute, of which Mr. Sanchez is a director. The board determined that Mr. Sanchez does not have a direct or indirect material interest in the transaction and that such transaction does not impair Mr. Sanchez’s independence.

In determining that Mr. Westbrook is independent, the board considered that, in the ordinary course of business, Mosaic Company, of which Mr. Westbrook is a director, sold various products to our company on anarm’s-length basis during the fiscal year ended December 31, 2016. The board determined that Mr. Westbrook does not have a direct or indirect material interest in such transactions and that such transactions do not impair Mr. Westbrook’s independence.

In determining that Ms. Harrison is independent, the board considered that, in the ordinary course of business, Colgate-Palmolive Company, of which Ms. Harrison is President of Global Oral Care, purchased various products from our company on anarm’s-length basis during the fiscal year ended December 31, 2016. The board determined that this arrangement did not exceed the NYSE’s threshold of 2.0% of Colgate Palmolive Company’s consolidated gross revenues, that Ms. Harrison does not have a direct or indirect material interest in such transactions, and that such transactions do not impair Ms. Harrison’s independence.

Section 2.8 of our bylaws also provides that a majority of the boardBoard of directorsDirectors be comprised of independent directors. Under our bylaws, an “independent director” means a director who: | 1. | is not a current employee or a former member of our senior management or the senior management of one of our affiliates; |

| 2. | is not employed by one of our professional services providers; |

| 3. | does not have any business relationship with us, either personally or through a company of which the director is an officer or a controlling shareholder, that is material to us or to the director; |

| 4. | does not have a close family relationship, by blood, marriage, or otherwise, with any member of our senior management or the senior management of one of our affiliates; |

| 5. | is not an officer of a company of which our Chairman or Chief Executive Officer is also a board member; |

| 6. | is not personally receiving compensation from us in any capacity other than as a director; and |

| 7. | does not personally receive or is not an employee of a foundation, university, or other institution that receives grants or endowments from us, that are material to us, the recipient, or the foundation/university/foundation, university, or institution. |

| | | | 18 | | ADM Proxy Statement 2020 |